maryland ev tax rebate

Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of whether you own or lease the vehicle. Maryland EV Tax Credit Extension Proposed in Clean Cars Act of 2021.

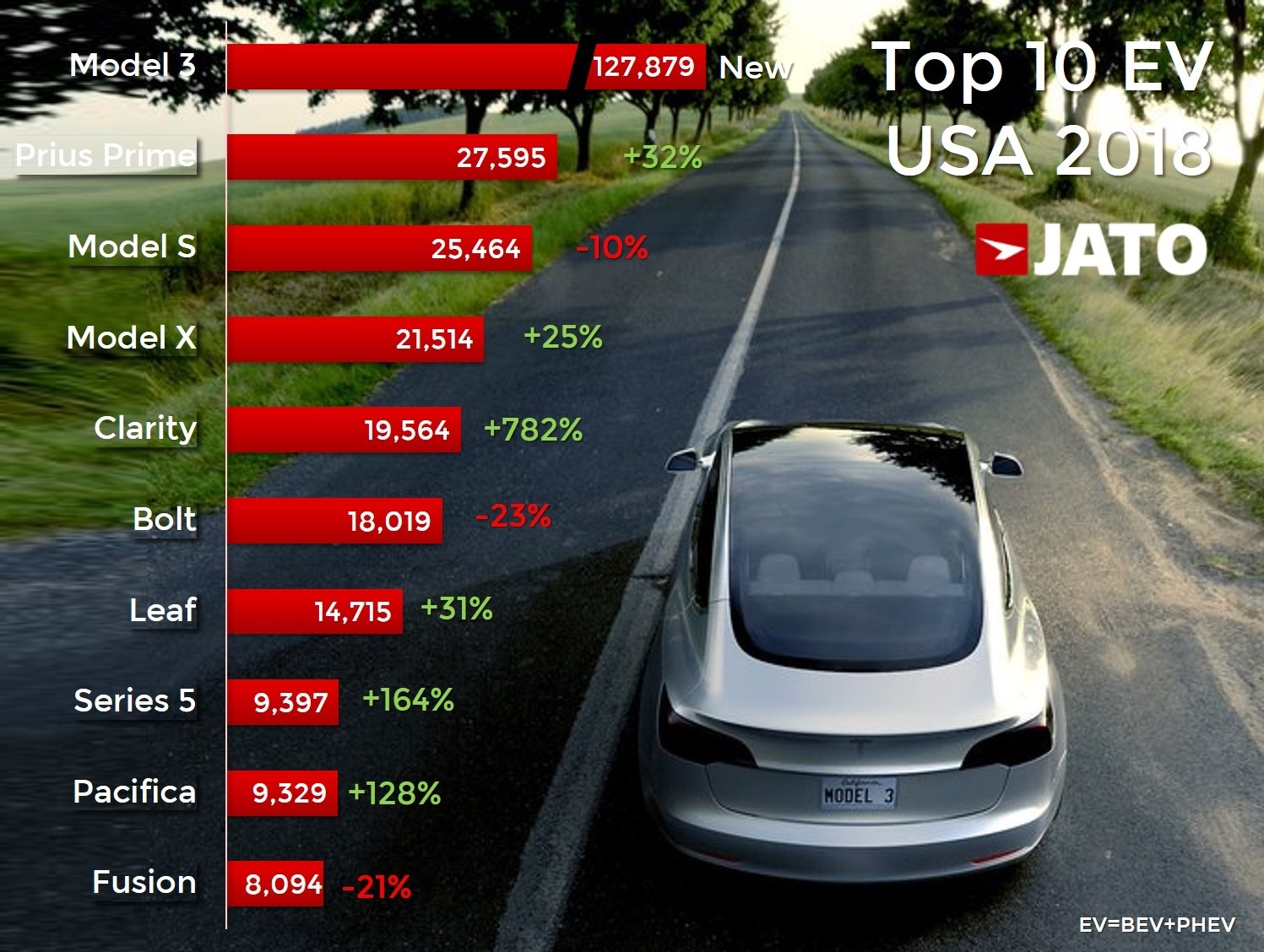

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Applicants must demonstrate compliance with state local andor federal law that applies to the installation or operation of qualified EV charging station.

. In Maryland several energy companies offer a 300 rebate for individuals who install a qualifying level 2 charger for their electric vehicle EV. As an approved vendor with multiple utilities well guide you through the entire process. Tax credits depend on the size of the vehicle and the capacity of its battery.

Anne Arundel Citizen Self Service. If funds are still available rebates will be issued based on the date received by. As if that werent enough already the state of Maryland rewards a 40 rebate to help you cover the cost of installing charging equipment at your home.

Federal EVSE credit of up to 30 or 1000 for charging station equipment. Say Thanks by clicking the thumb icon in a post. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids.

Other requirements may apply. Maryland offers a credit. While qualifying EVs and PHEVs are eligible for the federal tax credit the state of Maryland also offers unique opportunities for drivers of these types of vehicles.

Marylanders who purchased a plug-in electric vehicle since funds were depleted for the 3000 state excise tax credit have been waiting to see if the legislature will reauthorize funding for the program. Complete instructions on how to apply for the Maryland EVSE Rebate are located on the MEA Program page. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle.

The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. As of July 1 2022 the Electric Vehicle Rebate Fund has a balance of 17909043. Will There Be New Federal Electric Vehicle EV Tax Expansions.

If two plug-in electric vehicles are jointly owned by individuals each individual is entitled to receive excise tax credit for one of the vehicles So when the Model Y comes out we can still qualify for the rebate assuming its under 60k. And 5000 for retail service stations. 250 complimentary charging on EVgo network with any NEW LEAF purchase or lease.

Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation. Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids. 7201 Corporate Drive Hanover MD 21075.

And at 29 the transportation sector is the biggest contributor to national greenhouse gas emissions. Listed below are incentives laws and regulations related to alternative fuels and advanced vehicles for Maryland. The rebate is up to 700 for individuals.

Low income applicants are given priority in rebate disbursement. The total amount of funding that is available for the fiscal year 2021 July 1 2020 to June 30 2021 is 1800000. Purchasers were encouraged to file a form to reserve a place in the.

The MD EV excise tax credit is not income. Anne Arundel County Property Taxes. The rebate amount for residential charging stations is 40 of the equipment purchase price and installation cost up to 700.

Whether youre considering switching to an electric vehicle EV or just curious about your options we provide an introduction to electric vehicles. All LEAFs eligible for Federal Tax Credit. Batteries For a Range Of Lifestyles.

Tax Bills Payoff Redemption Information. Between July 1 2021 and June 30 2022 the rebate may cover 40 of the costs of acquiring and installing qualified EVSE or up to the following amounts. EV Incentives and Savings Calculator.

January 5 2021 Lanny. Marylands incentive program Electric Vehicle Supply Equipment EVSE Rebate Program 20 grants rebates to individuals for home use businesses for employees and customers and retail service stations. Ad Build Price Locate a Dealer in Your Area.

B1 EVSE Equipment Cost B2 EVSE Installation Cost B3 Total EVSE Cost B1B2 B4 Multiply B3 by 040 B5 Rebate Amount Lesser of 700 or B4 I solemnly affirm under penalties of law including those set forth in Maryland Code Section 9-20B-11 of the State. First Name Last Name Phone Number Business Email. You do not need to report that tax credit as income on your return.

Anticipated Program BudgetThe total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000. Electric Vehicle Rebates and Incentives. This means that pretty much all new EVs or PHEVs will.

Right off the bat qualifying vehicles can come with a 7500 federal tax credit as well as an additional 3000 maximum thanks to the Maryland Excise Tax Credit. The state of Maryland offers vehicle vouchers equipment rebates and free travel on HOV lanes. Electric car buyers can receive a federal tax credit worth 2500 to 7500.

Baltimore City Office of Finance. 469 City Hall 100 N. Electric Vehicle EV Charging Station Rebate Program.

Get More Power Than Ever With a Nissan Electric Car. Applicants are encouraged to thoroughly review the FY23 EVSE Rebate Program Funding Opportunity Announcement FOA below. Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit updated 5132022.

Find personalized governmental incentives and extra EV perks with our new tool. Marylands 3000 excise tax credit on EV vehicles and hybrids is still depleted for the fiscal year but it may be funded again in the future. Find Your 2021 Nissan Now.

Maryland Laws and Incentives. The Maryland EV Tax Credit is a separate program from the EVSE rebate. Marylands state electric vehicle tax credit program has proven so popular that rebate funding was depleted for the entire fiscal year before it even began on July 1 2019.

Maryland residents who purchase an electric vehicle are still. After the application period closes rebates will be issued to eligible applicants based on funding availability. Solar Canopy Electric Vehicle EV Infrastructure.

This is a refund of a tax you already paid and no more. A whopping 90 of the energy consumed from transportation in the US comes from petroleum. The state offers a one-time tax credit of 100 per kilowatt-hour of battery capacity up to a maximum of 3000.

For Maryland residents who purchase a new EV or PHEV within state lines there are several incentives to take advantage of thanks to the Maryland Clean Cars Act of 2019 HB1246. For example the Electric Vehicle Supply Equipment Rebate Program 1 is offered by the Maryland Energy Administration and may reimburse some of the costs associated with purchasing and installing charging equipment. In other words it is not a refundable tax credit which would be income because it would be over and above the tax you paid.

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Federal Rehabilitation Investment Tax Credit American Architecture Architecture 18 Century House

Automakers Ask Congress To Lift Electric Vehicle Tax Cap Cbs Baltimore

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Electric Vehicles Charge Ahead In Statehouses Energy News Network

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Volkswagen

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

U S Senate Panel Wants To Raise Ev Tax Credit As High As 12 500

Maryland Ahead Of Most Us States In Push For Electric Cars

Latest On Tesla Ev Tax Credit June 2022

Ev Tax Credit U S Senator Likely Would Block Passage Of Ev Tax Credits Auto News Et Auto

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Why You Should Buy An Electric Vehicle News Effinghamdailynews Com

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Ev Tax Credit U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Auto News Et Auto

Maryland Ahead Of Most Us States In Push For Electric Cars

2015 Ford Fusion Ford Fusion 2013 Ford Fusion Ford

Mia Electric Mia U Minivan 16 999 Made In France Available In Europe Electric Van Electricity Mini Van

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato